en

FR

DE

IT

Got questions? We’ve got the answer!

Can’t find a satisfactory answer below?

The information provided on this page is for general and informational purposes only. It does not constitute advice, a personalized recommendation, or an offer. Despite the care taken in its preparation, the author or the website publisher cannot be held liable for the content.

- App

- ESG strategy

- Fees

- Frequently asked questions

- Interest rates

- Payment / Transfer

- Pillar 3A

- Tax

- Technical problems & support

- Vested benefits

- Withdrawing funds

The Total Expense Ratio (TER), or the sum of the costs of each investment fund making up a Pilla Selection Index ESG strategy, varies between 0.19 % and 0.23 % depending on the equity component selected (ESG 20, 35, 55, 75 or 95). You can find this information on the fact sheets for each investment strategy.

You can subscribe to a Pillar 3A if you meet all three of the following conditions:

- You are of legal age (at least 18 years old)

- You carry out a gainful activity in Switzerland, either as an employee or as a self-employed person

- Your income must be subject to AHV (Old Age and Survivors’ Insurance)

If you are a cross-border worker, you can also subscribe to a Pillar 3A. However, in order to benefit from the tax deduction, you must hold the quasi-resident status. More specifically, you must live in a canton where tax at source is levied and be able to prove that 90% or more of your total gross worldwide income, including your spouse’s, is taxed in Switzerland.

To better understand the implications of this irreversible decision, it is recommended to run a simulation with a tax advisor.

No, you’re under no obligation to pay money into your Pillar 3A account. You decide when and how much you pay. As long as you respect both the maximum contribution deadline (December 20th each year) and the annual contribution limit.

When registering or logging in: on the Registration/Login page, look for the two bold capital letters in the top right corner that indicate the current language setting. This opens up a language selection page – just pick the language you want!

After registration: when you’re on the dashboard of your Pilla app, click on “More”, then select “Settings” and choose “Language”.

1. From the home screen (Dashboard) of your app, click on "...More"

2. Go to the "Documents" area

3. Select the "Other" category

4. Download the "Pillar 3A surrender request" form

5. Send the form to our partner Liberty by e-mail: info@liberty.chWhen you’re on the Pilla app home page, click on “Login” and then “Forgot password”.

To ensure your account remains secure, any password change is protected with a text message sent to your registered mobile phone.

When you’re on your dashboard, click on the product in your portfolio, then on the “+” icon and finally on the “Contribute to Pillar 3A” icon. The operation may take several days.

Your risk profile is determined on the basis of the answers you give to various questions about your income, expenses, assets, time horizon, and so on. The more accurate your answers, the more precise your risk profile will be.

When you make a request to Customer Support, it will be dealt with within 48 hours by a Pilla advisor located in Switzerland. In some cases, we may need to forward the request to our partner Liberty.

When you’re on the dashboard of your Pilla app, click on “More” then “Support”. Then fill in the contact form.

When you are in the app, select a product in your existing portfolio, click on the “+” and then “Adjust your strategy”.

Once you’ve downloaded the Pilla app and logged in, click on “Vested Benefits” and follow the account opening process.

Once you’ve downloaded the Pilla app and logged in, click on “Pillar 3A” and follow the account opening process.

At the beginning of each year, you’ll need to download the annual statement of pension contributions from the “Documents / Tax certificates” section. You can then submit it directly to the cantonal tax authorities for your tax return and benefit from the income tax deduction.

In the event of divorce, assets are generally divided between the ex-spouses.

In the event of death, the capital is paid to the designated beneficiaries (according to the beneficiary clause) or, failing that, to the legal heirs in a specific order (spouse, children, etc.).

No, that’s not necessary. Just go straight to the Pilla app and sign up – no need to open a bank account with Crédit Agricole next bank.

Yes, you can withdraw all or part of your Vested Benefits. However, this is subject to the following conditions:

- The withdrawal must be made with a view to acquiring a property for your own use

and

- Up to age 50: you can withdraw your entire Vested Benefits credit

- After age 50: you may only withdraw the amount available at age 50 or half of the current Vested Benefits amount, whichever is greater

You can withdraw funds straight from your Pilla app. It’s easy – just go to your dashboard, click on “+”, select “Withdraw your funds”, choose your reason and send to our partner Liberty.

No. If you sign up for a product on the Pilla app, you remain a Pilla customer and have no relationship with Crédit Agricole next bank. However, if you’d like to enjoy any of the products and services offered by Crédit Agricole next bank, simply submit a request through the contact form on our app or website, or visit one of their branches in Switzerland.

With Pilla, you can invest your Pillar A or Vested Benefits capital in a savings account or in investment funds via a Pilla Selection Index ESG strategy. A savings account is the most prudent option: you benefit from a fixed rate of interest, but with moderate returns. By choosing an ESG investment strategy that uses investment funds, you diversify your portfolio and enjoy additional long-term return opportunities, but you also take on greater risks. There’s nothing to stop you investing part of your assets in a savings account and the rest in investment funds. The choice is yours!

Yes. A tax certificate is available in the “Documents” section of the app. Simply click on “Tax certificates”.

Yes, it’s possible to make buy-backs into your vested benefits, but only in specific cases, such as to make up pension shortfalls or for advance contributions to buy a home. The buy-backs enable you to increase your retirement capital and reduce your tax bill, but they are subject to rules and restrictions.

Anyone with an income subject to AVS can take out a 3rd pillar. Why? For example, to supplement their pension provision and enjoy a more comfortable income when they retire, or to finance a life project such as buying a property.

Pillar 3A, or linked pension provision, offers attractive tax benefits every year. However, the capital you have accumulated can only be withdrawn under certain conditions, such as when you retire, buy a home or start a self-employed business.

Pillar 3B, also known as flexible pension provision, offers greater flexibility. Your capital is available at all times, which is ideal for achieving your savings goals. However, this solution does not offer the same tax advantages as Pillar 3A.

It’s never too early or too late to open a 3rd pillar. You can take out a policy from the age of 18 and no later than 5 years before you retire. Please note that the conditions are slightly different for Pillar 3A and Pillar 3B.

You will find your funds in the application within 48 to 72 hours. After that, if the payment is still not visible, don't hesitate to contact the bank using our contact form.

You can contact us using our contact form and we'll make the necessary changes for you.

Your portfolio will be automatically accessible within 24 hours. After that, if the status has not changed, don't hesitate to contact the bank via our contact form.

If you do not complete your Pilla registration, your data will be automatically deleted after 30 days.

If you wish to delete your data before this deadline, you can send us a request via our contact form.Yes. However, daily allowances you receive from unemployment insurance must be considered as income subject to OASI.

If you change jobs, you are legally obliged to transfer your 2nd pillar assets to your new pension fund. As benefits differ from one pension fund to another, either more or less capital is contributed than is needed to cover the regulatory benefits of the new pension fund.

If the benefits offered by the new pension fund aren’t as good as those from your previous one, you should explore all available options with the new pension fund before transferring: transferring all of your 2nd pillar assets, depositing the surplus into a vested benefits account, etc.

When you’re on the dashboard of your Pilla app, click on the Vested Benefits product in your portfolio, then on the “+” icon, then on the “Transfer your funds” icon, and finally select “Request a transfer to a Swiss pension fund”.

No. Pillar 3A or Vested Benefits capital are not included in your assets. So you don’t have to declare them or include them in your tax return. The same applies to capital gains, which are exempt from income tax. However, a preferential tax is levied on the amount of capital withdrawn, the percentage of which depends on which canton you live in.

The rules governing the foundations are available on the website of our partner Liberty.

When you’re on the dashboard of your Pilla app, click on “More”, select “Documents” and then the product you need.

The legal notice is available on the Pilla website in the “Legal notice” section at the bottom of the page.

The legal notice is available on the Pilla website in the “Legal notice” section at the bottom of the page.

There are two main advantages to buying back your contributions: a better retirement and tax benefits. Firstly, the amount in your Pillar 3A will strengthen your private pension provision and increase your retirement capital. Secondly, the amount paid in can be deducted retroactively from your taxable income.

This step is essential so that our partner Liberty can identify you formally and finalise your registration.

- Greater flexibility in the event of withdrawal

Your 3rd pillar assets can only be withdrawn once. That’s why we recommend having several of them. This allows you to stagger your withdrawals.

- Reduce your tax burden

Withdrawals from a pillar 3a account are subject to capital gains tax. If you withdraw the majority of your assets in a single year, you’ll face a higher tax rate and a much larger tax bill. So it’s a good idea to spread your assets over several 3a accounts, staggering your withdrawals to reduce your tax burden.

- Diversify your capital

With several Pillar 3A accounts at your disposal, you can create a variety of investment strategies. For example, you could open a risk-free Pillar 3A with 100 % cash and another one invested in a Pilla Selection Index ESG strategy to take advantage of market return opportunities.

Important note: even if you have several Pillar 3A accounts, the authorised annual contribution limit does not change. For further information on amounts , please refer to the question: What is the maximum annual contribution for Pillar 3A in 2025?

Your phone model might be outdated, or perhaps you just need to install the latest update. Please update your system. If the problem persists, you can send a request via the contact form so we can help you.

Although the Swiss pension system is one of the most efficient in the world, it is facing a number of structural challenges that are noticeably weakening the 1st and 2nd pillars. In particular, Switzerland’s ageing population combined with a shrinking workforce will substantially affect pensions in the near future. This is why it’s important to ask yourself the right questions well in advance and to secure your financial future. It’s never too early, but it’s often too late!

With Pilla, opening a Pillar 3A account is simple, quick and secure. Our app is supported by Crédit Agricole next bank, a FINMA-accredited Swiss bank. What’s more, you’ll benefit from one of the most attractive interest rates on the market. Lastly, Pilla is the ideal solution for boosting your retirement capital, with turnkey ESG investment strategies perfectly tailored to your risk profile.

With Pilla, you benefit from a simple, fast and secure app to manage your vested benefits, as well as one of the best interest rates on the market. And if you’re looking to boost your retirement capital, we’ve put together some turnkey ESG investment strategies for you, tailored to your risk profile.

Yes, it's perfectly possible!

We talk about buying back "pension gaps", i.e. the difference between what you could have contributed over the year and what you actually paid in.

Maximum authorised amount - amount paid in = gap that can be bought back

Until now, these amounts not paid into your Pillar 3A - and the associated tax benefits - were lost from 1 January of the following year. Under the new law, the corresponding amounts not paid in over the previous 10 years can be bought back from January 2026, but only as of 2025.

You cannot make voluntary contributions into your Vested Benefits account. Only the transfer of assets from a pension fund or another vested benefits account/policy is permitted.

Yes. Just make sure that you have activated the facial or fingerprint recognition feature in your phone’s settings.

No. You can only log in or subscribe to Pilla products via the mobile Pilla app.

For the Pillar 3A product, you can open 5 Pillar 3A portfolios, and for the Vested Benefits product, you can open only one portfolio.

Yes, you can. Simply open two Pillar 3A portfolios and select the investment strategy you want for each one.

No, that is not possible. You can only select the risk profile recommended by the Pilla app or a risk profile lower than that recommended by the Pilla app. This applies to both pillar 3A and vested benefits.

As soon as you have completed the process of subscribing and opening your vested benefits, from your dashboard

- click on the Free Pass service in your portfolio,

- then on the "+" icon

- then on the "Transfer credits" icon.

All you have to do is follow the procedure.

You can also delegate the transfer to our partner Liberty. To do this, select the option when you open your Pilla account. All you need to do is indicate your current foundation and your contract number.

Once you have completed the process of subscribing and opening your Pillar 3A, from your dashboard

- click on the Pillar 3A benefit in your portfolio,

- then on the "+" icon

- then on the "Contribute to Pillar 3A" icon

- and finally on the icon "From an existing Pillar 3A".

You can also delegate the transfer to our partner Liberty. To do this, select the option when you open your Pilla account. All you need to do is indicate your current foundation and your contract number.

This is the public pension scheme or OASI/DI (old age and survivors’ insurance and disability insurance). This pay-as-you-go system (where today’s workers fund today’s pensioners) is designed to ensure essential living standards. It is compulsory.

It’s an account where you can "park" the capital you’ve accumulated in your pension fund (or 2nd pillar assets) after leaving your employer.

The Pillar 3A account is a form of individual pension plan in Switzerland that allows you to supplement your 1st pillar (OASI) and your 2nd pillar (LPP). It comes in the form of either a traditional bank account or an insurance policy. Its main purpose is to help you build your personal pension pot for retirement or other life goals, while offering tax benefits and protection against risks such as death or disability.

Pilla is a 100 % digital, 100 % Swiss pensions app designed to simplify access to Pillar 3A and Vested Benefits solutions. It gives you the freedom to build up and manage your pension pot independently, at any time and from anywhere.

The second pillar refers to occupational pension provision (LPP), or the funded pension system, which aims to maintain your usual standard of living after retirement. It is mandatory.

The third pillar, also known as individual pension provision, allows you to build up savings with the goal of ensuring your future financial security (retirement, real estate purchase, moving abroad, etc.). It also helps you save on taxes and provides coverage against the risk of death or disability. It can take the form of either Pillar 3A or Pillar 3B. Participation is entirely optional.

In Switzerland, the pension system is made up of three pillars: public pension provision, occupational pension provision and individual pension provision. Its aim is to guarantee the financial security of every citizen, whether resident in Switzerland or abroad, in the event of retirement, disability or death. It dates back to the creation of OASI/DI/IC in 1948 and is considered to be one of the most reliable systems in the world.

The 0.50 % management fee is deducted at the end of each year directly from the total amount invested in each product.

The annual lump-sum fee of 0.50% covers all costs, fees, charges and expenses relating to the performance of all functions and tasks of the participants in connection with the client's account/custody account. Excluded are exchange fees, taxes (e.g. VAT, stamp duty, etc.) and TER (between 0.19% and 0.23%).

When you’re on the dashboard of your Pilla app, click on “More”, then select “Support” and complete the contact form to let us know about your change of address.

No problem, we’ll take care of it!

When you’re on the dashboard of your Pilla app, click on “More”, then select “Support” and complete the contact form to let us know about your change of name.

Have you recently changed your phone number? It’s essential that you record it. When you’re on the dashboard of your Pilla app, click on “More”, then on the icon to the right of your First Name / Last Name (at the top of the page), then select the pencil icon next to “Your personal details” and change your mobile number.

If you’ve changed phones, you need to reinstall the Pilla app on your new phone and log in again using your usual login details.

Don’t panic! Once you’ve reported your mobile as lost or stolen, simply reinstall the Pilla app on your new device and sign in with your credentials.

If you’ve contributed more than the annual limit to your Pillar 3A with Pilla, no need to worry! Our partner Liberty will return the surplus to you.

If you relocate outside Switzerland, you can either withdraw your 3rd pillar assets or leave them in your Pillar 3A account(s) with Pilla or another provider. However, you’ll need to withdraw your capital when you reach the normal OASI retirement age.

The 2nd pillar is a little different.

In principle, you can keep your vested benefits account, but specific rules apply to withdrawals depending on your destination (EU/EFTA or non-EU/EFTA country). If you move to a country outside the EU/EFTA zone, you can withdraw all your vested benefits. If you move to an EU/EFTA country, you will only be able to withdraw the over-obligatory part of your vested benefits under the Agreement on the Free Movement of Persons between Switzerland and the EU. The obligatory part must remain in a vested benefits account or policy in Switzerland until retirement age or in the event of an insured risk (death or disability).

You can open or transfer a Pillar 3A with Pilla from as little as CHF 1. Our solution is designed to be accessible to all!

The current interest rate applicable to the savings part is 0.25% for the Vested Benefits account.

The current interest rate is 0.55% for Pillar 3A.

In 2026, the contribution limits are as follows:

- Employed or enrolled in a pension fund: CHF 7'258

- Self-employed or not

- Member of a pension fund: Max. 20 % of net income, up to a maximum of CHF 36'288

The conditions for withdrawing a Pillar 3A are as follows:

- At the earliest five years before the reference age (OASI age) and at the latest five years after that age, provided you are still in gainful employment.

However, you can still withdraw your 3rd pillar capital in the following situations:

- You are launching your own business as a self-employed professional

- You are leaving Switzerland permanently

- You are purchasing a home for your personal use (primary residence) or are paying off an existing mortgage

- You are in receipt of a disability pension

- You are making a pension fund buy-back to catch up on the years when you didn’t contribute to your 2nd pillar

You can withdraw funds straight from your Pilla app. It’s easy – just go to your dashboard, click on “+”, select “Withdraw your funds”, choose your reason and send to our partner Liberty.Like the 3rd pillar, vested benefits can only be withdrawn and closed at legal retirement age. However, there are exceptions that allow early withdrawal of capital:

- Purchasing a home for your personal use (primary residence)

- Financing the launch of your business as a self-employed professional

- Leaving Switzerland permanently

- You are working: you have an income subject to AHV and have not reached the age of 70 at the time of the purchase

- Priority to the present: you have already paid in the maximum authorised amount for the current year

- Retroactivity: pension gaps from 2025 onwards that are less than 10 years old

- Full years: pension gaps for a given year can only be purchased at one time

- Maximum amount: the total amount purchased must not exceed the current statutory maximum amount- Build up your pension pot for retirement or future life goals

- Reduced taxation by deducting annual contributions from income tax

- Flexibility: pay in when you want!

- Interest rate of 0.55 % on the savings portion is among the best rates on the market

- 100 % digital: from subscription to management, everything is done online, with no paperwork or appointments.

- Open an account in less than 10 minutes

- Intuitive interface: seamless navigation

- Accessibility: 24/7 real-time tracking of your capital

- Flexibility: choose between savings, fund investments or a combination of both – and adjust your allocation whenever you want.

- Within everyone’s reach: you can start your pension plan from as little as CHF 1.00.

- Attractive conditions:

- One of the best interest rates on the market for the cash portion of your investment: 0.55 % for Pillar 3A and 0.25 % for Vested Benefits

- Access to turnkey ESG investment strategies, aligned with your risk profile

- Competitive management fees: only 0.50 % of the capital invested in securities

With a vested benefits account, your pension fund assets are safe. You can then transfer them freely from one financial institution to another. Vested benefits are also advantageous from a tax point of view: your capital is not included in your assets and is therefore not taxed.

The first advantage of Pillar 3A is tax savings. The annual payments you make are deductible from your income tax. For every CHF 1'000 paid into your Pillar 3A, you can save between CHF 200 and CHF 400, depending on your taxable income and where you live. The retirement capital you build up through Pillar 3A is not included in your assets and is therefore not taxed. Lastly, if you want to buy a home, you can use your 3rd pillar to indirectly pay off your purchase.

To open an account with Pilla, you’ll need the following:

• A camera phone compatible with at least :

Android 7

iOS 15

• Access to your personal inbox from your phone

• A phone number starting with +41, +33, +39 or +49

• A valid identity document

• Your OASI number

• The membership number of your previous pension fund (in the event of a transfer)

In Switzerland, you can open a vested benefits account (occupational pension) when you leave your job and are not immediately enrolled in a new pension fund, or when your income is below the LPP entry threshold. This includes people who are taking a career break, relocating abroad or becoming self-employed.

Pilla is an app developed by Crédit Agricole next bank in partnership with Liberty Fondation de Prévoyance.

Liberty is an independent provider based in Schwyz and one of the market leaders in Switzerland, offering a wide range of pension solutions. Our partnership gives our customers access to their various foundations (3rd pillar, vested benefits, etc.). Their custodian bank is Valiant Bank.

Developed in partnership with Liberty Fondation de Prévoyance, the Pilla Selection Index ESG 20, 35, 55, 75 and 95 strategies incorporate ESG (Environmental, Social and Governance) criteria. This means that they exclude or limit investment in controversial sectors such as arms, tobacco, fossil fuels, gambling or adult content. Our funds also actively encourage companies to adopt sustainable and responsible practices.

Pilla is aimed at Swiss residents with a Swiss telephone number (+41), as well as cross-border commuters with a number starting with +33, +39 or +49. If you are moving house, you can contact Crédit Agricole next bank to work together to find the insurance solution best suited to your situation.

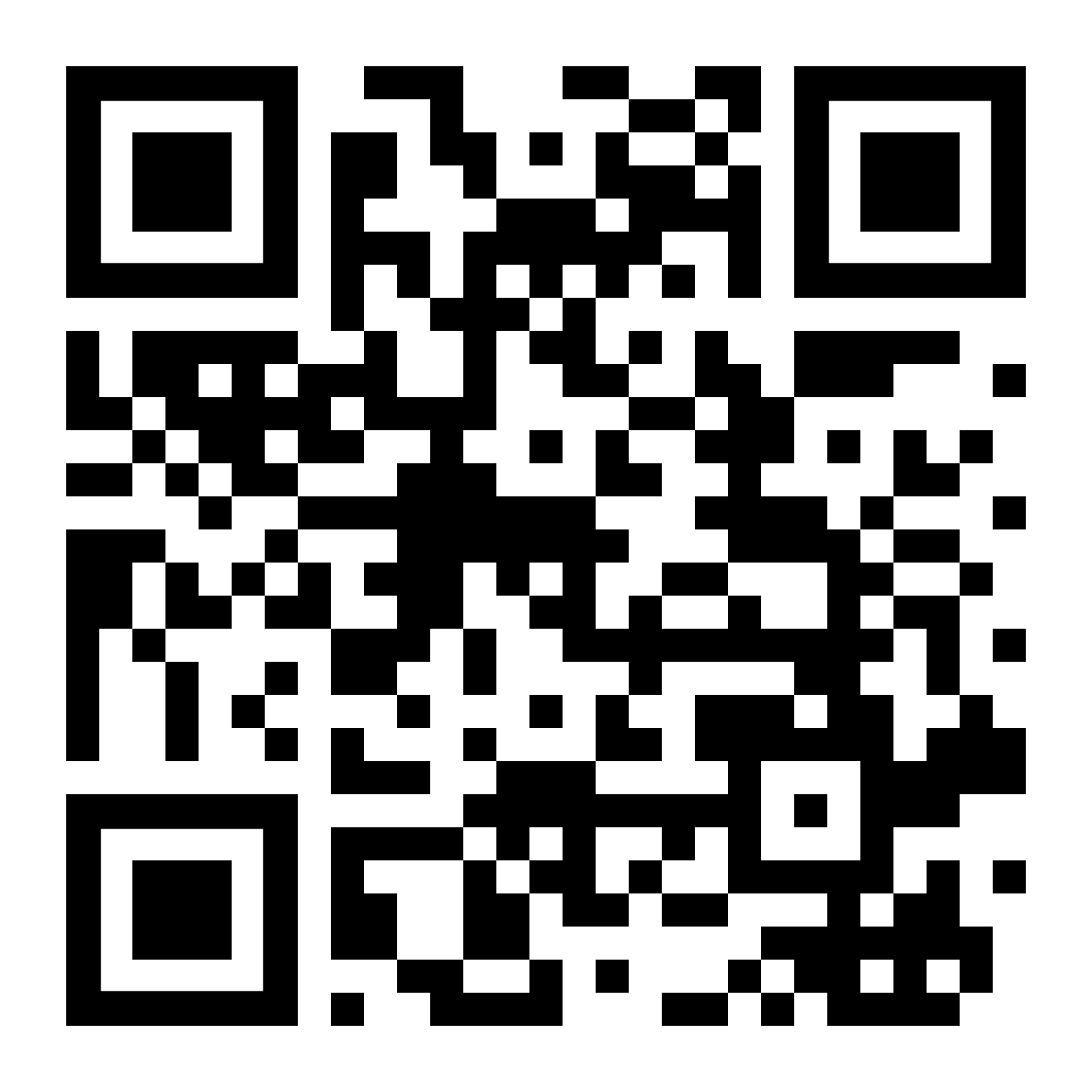

Your pension at your fingertips

Manage and optimise your pension at any time.

Scan this QR code with your smartphone.

Available on