en

FR

DE

IT

Open a 3rd pillar account the easy way

A clear, simple Pillar 3A that’s just right for you.

Benefit from a guaranteed return of 0.55%.

Investment Solutions

Solutions for your 3A savings

Simple options tailored to your needs

At Pilla, we help you choose the best way to save for your retirement. Whether you prefer a risk-free investment with 100% secure savings, or a higher-yield (but riskier) investment to maximise your capital, we have the solution for you.

Your Pillar 3A 100% savings

Opt for security with an account where your capital is guaranteed and works at a fixed rate among the best on the market: 0.55%. Ideal for cautious investors who prefer stability and peace of mind.

Your Pillar 3A investments

With this solution, your money is invested in investment funds.

The aim is to take advantage of market opportunities and achieve higher returns over the medium to long term.

We have designed 5 investment profiles, each with its own risk level and strategy.

These diverse solutions, from cautious portfolios to more dynamic allocations, help you confidently plan for retirement while securing your financial future.

With Pilla, you can find the perfect balance between security and performance, so you can grow your 3A savings with confidence.

How does it work?

A single app to manage your Pillar 3A

Simple, secure and 100% mobile. With the Pilla app, you can manage your retirement savings in just a few clicks. Control, adjust and optimise your Pillar 3A investments, whenever and wherever you want.

Your pension, your advantages

Advantageous conditions

Simple, competitive fees

With Pilla, you pay a flat management fee of 0.50% per annum on the capital invested for your pillar 3A. Added to these fees are the TER (or Total Expense Ratio) linked to the chosen investment strategies, which range from 0.19% to 0.23%, resulting in total fees of between 0.69% and 0.73%.

One of the best rates on the market

You’ll enjoy competitive returns on your uninvested funds: 0.55% on your Pillar 3A account.

You can start saving from as little as CHF 1.

Whether you’re just starting your pension journey or transferring an existing account, everything is designed to be accessible, straightforward and easy to understand.

Your pension at your fingertips

Manage and optimise your pension at any time.

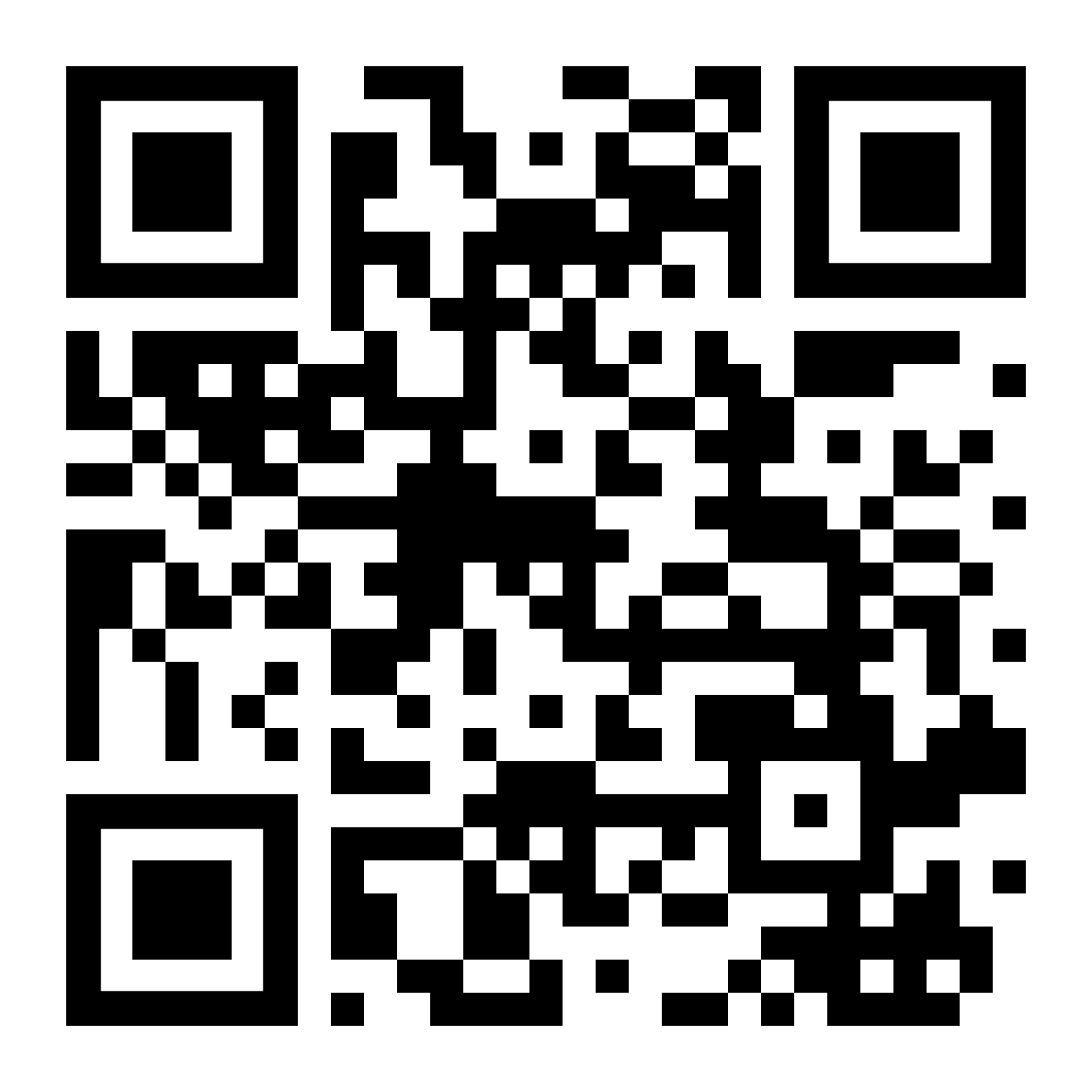

Scan this QR code with your smartphone.

Available on